ATAD3 update: significant amendments recommended by the European Parliament

ATAD3 update: significant amendments recommended by the European Parliament

The European Parliament proposes significant amendments to the Anti-Tax Avoidance Directive, commonly known as ATAD3. ATAD3 seeks to prevent the misuse of shell companies for tax purposes. Compared to the initial draft Directive, the proposed amendments may provide relief for international organisations.

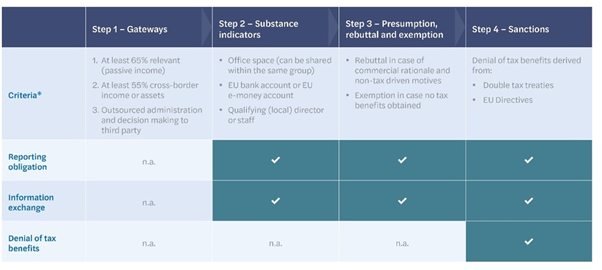

In essence, ATAD3 imposes increased reporting obligations and denial of tax benefits under double tax treaties and EU Directives for entities that are considered shell companies. To identify whether ATAD3 applies to you, the following approach applies:

- Gateways: identify whether a company is a shell or not by assessing whether it meets all three gateway tests (see table). A typical example of a shell in international group structures is when management and administration of a subsidiary are outsourced.

- Substance indicators: shell companies must annually report whether minimum substance requirements are met.

- Presumption and rebuttal: not meeting the minimum substance requirements results in the presumption of lack of substance. This presumption can be rebutted by providing additional information to the local tax authorities on the substance.

- Sanctions: if the presumption is not rebutted, EU tax benefits and tax treaty benefits are denied to the shell company.

Proposed amendments

The proposed amendments of the European Parliament seek to establish a further framework to combat the misuse of shell companies. In some ways, it broadens the scope for application of ATAD3, while simultaneously the amendments provide more possibilities to demonstrate substance. We have summarised the most significant changes below.

Step 1 – Gateways

The European Parliament proposes to reduce the thresholds of gateways one and two. To be considered a shell company, the following amendments are being proposed:

- The company must have at least 65% (previously 75%) relevant passive income; and

- more than 55% (previously 60%) of the income or investments are cross-border, or 55% (previously 60%) of the assets are located outside the entity’s state of residence.

Additionally, it is proposed that an entity only meets the third gateway if it outsources its administration and decision-making to a third party. Outsourcing these functions to an associated company will no longer trigger the application of ATAD3. Generally, companies are regarded as associated if there is a direct or indirect ownership relation of at least 25%.

Whilst included in the initial draft Directive, it is proposed that companies with at least five employees generating passive income are no longer exempted from the increased reporting obligations of ATAD3.

Step 2 – Substance indicators

The proposed amendments seem to relax ATAD3’s minimum substance requirements.

Under the proposed amendments, office spaces may be shared with companies within the same group and bank accounts held through e-money institutions in the EU contribute to demonstrating substance.

In contrast to the initial draft Directive, the proposals provide that local resident directors may be employed by third parties and perform directorships for non-associated companies.

Step 3 – Presumption and rebuttal

The proposed amendments stipulate that Member States should consider a request to rebut the presumption of lack of substance within nine months of the submission of the application. This request is considered to be accepted in the absence of an answer from the Member State after the expiry of this nine-month period.

Step 4 – Sanctions

ATAD3’s proposed revisions also address the consequences of being treated as a shell company. If adopted, Member States will have to justify the refusal of a tax residency certificate in an official statement, increasing the administrative burden on local tax authorities.

What’s next?

The amendments proposed by the European Parliament will be included into ATAD3 as non-binding recommendations. If adopted, ATAD3 should be implemented into national legislation of the EU Member States by 30 June 2023 and come into effect by 1 January 2024. The expected one-year deferral to 1 January 2025 has not been included in the non-binding recommendations.

ATAD3 requires unanimity for adoption. It is not yet clear whether all Member States will reach an agreement on ATAD3 and in what form it will be implemented. Nonetheless, it is critical to assess the implications of ATAD3 for international tax structures and act now to prevent adverse tax consequences moving forward. Should the directive be put into effect speed will be vital since the gateways use a reference period of the two previous tax years, meaning the clock has already begun to tick.

Brazil’s 2026 tax reform: preparing for transition

Starting in January 2026, Brazil will enter the transition phase of its most ambitious tax reform in decades — a structural overhaul that will reshape the taxation of goods and services. While the reform aims to simplify one of the world’s most complex tax systems, its scale and impact cannot be underestimated: it will redefine […]

Pillar 2 GloBE rules technical series: how complex structures and reorganisations impact GloBE

The ninth session of series on Pillar 2 GloBE model rules focuses on the challenges posed by complex structures and reorganisations and how they impact Global Anti-Base Erosion (GloBE) income. The GloBE rules apply to multi-national enterprise (MNE) groups that have consolidated revenue of EUR750m or more in at least two of the four fiscal […]

Pillar 2 GloBE rules technical series: using elections to align and simplify GloBE computations

The seventh session of our 10-part series on Pillar 2 GloBE model rules focuses on how elections can help align GloBE income to mirror local tax treatment and iron out issues that could skew the effective tax rate (ETR). There are also elections that recognise the difficulty of obtaining the numerous data points needed to […]

Pillar 2 GloBE rules technical series: navigating adjusted covered taxes

The sixth article of our series on Pillar 2 GloBE model rules focuses on how to identify the key principles of adjusted covered taxes. Adjusted covered taxes is the numerator in the formula for determining the effective tax rate under the main Pillar 2 rules. As well as discussing points such as the definition of […]

Pillar 2 GloBE rules technical series: unpacking and applying GloBE model rule adjustments

Continuing our technical series on Pillar 2 GloBE, article five aims to assess how to determine your Financial Accounting Net Income or Loss (FANIL) by applying the relevant OECD-listed adjustments, alongside a brief overview of other additional adjustments. As discussed in previous articles in this series, calculating any top-up tax liability under Pillar 2 begins […]

Pillar 2 GloBE rules technical series: understanding how Pillar 2 GloBE impacts tax accounting

Continuing our technical series on Pillar 2 GloBE, this article aims to give an overview of the relationship between tax accounting and Pillar 2 GloBE. As well as highlighting basic accounting principles, the article will summarise issues relating to the computation of the effective tax rate, top-up tax, GloBE income or loss, covered taxes and […]

Next step in DAC9 legislation: council of the European Union reaches agreement on standardisation of GIR

In mid-February, the European Parliament (EP) voted by a majority to adopt the DAC9 legislative initiative. Now, the Council has reached a political agreement on the new EU directive. It acts as the sole legislator and will formally adopt DAC 9 after the revision is completed. The previous proposal by the European Commission primarily aims […]

Pillar 2 GloBE rules technical series: addressing MNE group complexities under Pillar 2 GloBE

Following on from article two in our technical series on Pillar 2 GloBE, this article aims to peel away further layers of how the GloBE rules define MNE groups. In particular, we will look at some of the more complex situations likely to arise in determining an MNE group. As discussed in our previous article, […]

Pillar 2 GloBE rules technical series: understanding MNE group structures through the lens of the GloBE rules

One of the fundamental exercises for in-scope multinational enterprise (MNE) groups subject to Pillar 2 GloBE rules is to gain an in-depth knowledge of constituent entities (CEs) and permanent establishments (PEs) on a country-by-country basis. It is an important task that will help ensure calculations required to determine your top-up tax liability in each jurisdiction […]

Risk management: adding value with a tax control framework

The tax risks facing global organisations increase every year. In the EU alone, data from the European Commission shows there are around 900 double taxation disputes, estimated to be worth €10.5 billion.These figures are likely to continue increasing over the coming years, as governments and tax authorities around the world align their approaches, increase global […]

Pillar 2 GloBE rules technical series: getting to know top-up taxes and safe harbours

With the Organisation for Economic Co-operation and Development’s (OECD) Pillar 2 Global anti-Base Erosion (GloBE) Rules now in play, understanding who, what, and how the regime will impact multinational enterprises (MNEs) is vital. With new OECD guidance being steadily released, keeping abreast of changes affecting how the rules are interpreted and what options an MNE […]

Maximising privately owned business efficiency with a tax control framework

Implementing a tax control framework (TCF) might sound like something only large multinational PLCs need to worry about. But for privately-owned businesses, a tax control framework also offers great opportunity. The risks a TCF guards against may be different in scope for a typical owner-managed business, but there remain significant penalties for the wrong approach. […]

Enhancing business sustainability through effective tax control frameworks

Sustainability challenges have become critical business imperatives in recent years. Regulators, stakeholders, investors, employees, customers – all expect a much higher degree of compliance and transparency. Businesses have got used to their performance in these areas being monitored and to being held accountable for any weaknesses. Although much of the focus on ESG (Environmental, Social […]

Tax transparency on allocation of group profits in the light of Public CbCR

Taxation has a key role for medium and large multinational companies in the process of developing a sustainable business model. Disclosure of complex tax information and transparency on profit allocation to group entities is key to this transformation process and will become a reality with new reporting standards and EU disclosure obligations. The Global Reporting […]

Implementing the right tax control framework

There are two main drivers for organisations looking for advice around tax control frameworks (TCFs). Sometimes it is a proactive strategy to check their tax affairs are in good shape or to better understand any potential liability risks, for example. Alternatively, they may already be aware of tax compliance issues they need to deal with […]

Using CbCR data as a Pillar 2 GloBE starting point

Designed to ensure that multinational enterprises (MNEs) pay a global minimum tax (GMT) of 15% in each jurisdiction where they operate and generate income, the Pillar 2 global anti-base erosion (GloBE) rules are now a reality for in-scope MNEs and very large groups with €750m consolidated global turnover. With some MNEs facing assessments as early […]

How to develop a robust tax control framework for your business

Developing and implementing a tax control framework (TCF) is a strategy being adopted by an increasing number of companies around the world. There is no universal approach to developing a TCF. At Forvis Mazars, based on our wide experience working with a diverse range of companies to implement tax control frameworks, we take a structured, […]

Is a change of tax mindset now needed?

For Singapore and many other countries that have traditionally leant on financial incentives to attract foreign direct investments, the ambition of a 15% minimum global tax presented by Pillar 2 Global Anti-Base Erosion rules (GloBE) heralds a new challenge. While there is little doubt that having a fairer international tax system is a much-needed move, […]

New app from the Mexican Tax Administration Service designed to determine the monthly VAT returns automatically

The Mexican Tax Administration Service (SAT) continues to innovate and invest in technology and artificial intelligence to make it easier and more efficient for taxpayers to file their monthly tax returns. On February 1st, 2024, The Mexican Tax Administration launched a new online platform for filing the monthly Value Added Tax (VAT) returns, which will […]

A basic guide to understanding Pillar 2 GloBE minimum top-up tax rules

As in-scope organisations* embark on a new Pillar 2 Global Anti-Base Erosion (GloBE) journey, having a clearer understanding of how jurisdictions will enact the global minimum 15% tax rule is vital. Notably, while Pillar 2 GloBE sets out model rules on what jurisdictions need to achieve, there is an element of flexibility in how each […]

The benefits of having a tax control framework

Tax control frameworks are becoming increasingly common as companies seek to manage their taxation, compliance, and risk management obligations more effectively and efficiently. So, what is a tax control framework, and what are the benefits? A tax control framework is a set of processes and internal control procedures that ensure a company’s tax risks are […]

UK Spring Budget 2024

The UK Spring Budget on 6 March 2024 was relatively measured in its tax policy decisions, despite a background of falling inflation and rising tax receipts. Below are some areas of interest for globally mobile individuals, those with UK staff, and those with business and investment interests. Main measures affecting individuals Main measures affecting those […]

The right tax approach: why companies need a tax control framework

Across the globe, an increasing number of companies are developing tax control frameworks to help them stay on top of their taxation, compliance and risk management obligations and objectives. These obligations are continually evolving, driven by a combination of both...

Ecological taxes: new updates in Mexico

Several Mexican states had imposed ecological taxes in order to encourage certain industries to reduce their polluting emissions. In addition, green taxes have recently been imposed as a consequence of the warning issued by the Mexico Climate Initiative (MCI) that Mexico’s carbon dioxide emissions could increase by up to 59.8% by 2050 if the country’s green […]

A basic guide to understanding Pillar 2 GloBE minimum top-up tax rules

As in-scope organisations* embark on a new Pillar 2 Global Anti-Base Erosion (GloBE) journey, having a clearer understanding of how jurisdictions will enact the global minimum 15% tax rule is vital. Notably, while Pillar 2 GloBE sets out model rules on what jurisdictions need to achieve, there is an element of flexibility in how each […]

IAS accounting requirements for Pillar 2: GloBE for periods ending 31 December 2023

Background to Pillar 2 (GloBE) Part of the ongoing work of the OECD to combat tax avoidance and targeted at low tax jurisdictions, the Pillar 2 – GloBE rules will apply to large organisations (>€750m of global revenue) with each country having its own rules implementing some form of 15% minimum tax, or otherwise risking […]

Green investments in Austria: new tax allowance introduced effective 2023

When the Austrian government – a coalition between the conservative People’s Party and the Green Party – presented their government program for 2020-2024, an “eco-social tax reform” was one of the key elements. The most recent measure has been the introduction of an investment allowance that especially incentivises “green investments”. The two main pillars of […]

How CARF, MiCA, and DAC8 will impact tax transparency in relation to the WEB 3 and other recent web developments

The development of new web communication systems such as WEB3 is making it very difficult for tax authorities to trace taxable transactions. However, measures proposed by the OECD and the European Union aim to provide a framework that will permit traceability of tax transactions. The technical characteristics of a crypto asset make it difficult for […]

Mexico approves the Multilateral Instrument (MLI) to implement Tax Treaty Measures

On 12 October 2022, the Mexican Government approved the Multilateral Instrument (MLI) related to the application rules for double taxation agreements (DTAs) to prevent Base Erosion and Profit Shifting (BEPS). The rules were published in the Official Gazette of the Federation on 22 November 2022. Included in the Mexican Government’s reservations and notifications are […]

EU’s new SAFE initiative to bolster existing tax evasion measures

The European Commission (EC) launched an initiative on 6 July 2022 concerning the fight against tax evasion and aggressive tax planning. As a result, a public consultation introducing the Securing the Activity Framework of Enablers (SAFE) directive has now been held. The proposed measures could increase compliance costs for all those involved in providing tax […]

Proposed changes to the offshore regime for passive income in Hong Kong

Background To address harmful tax competition, the European Union (“EU”) requires Member States to refrain from introducing any new harmful tax measures and amend any laws or practices deemed to be harmful. Regarding non-EU jurisdictions, the EU has also evaluated their tax regimes against international tax standards and put in place a list of noncooperative […]

The Google tax: The UK story, 7 years later

The Diverted Profits Tax (DPT), or what the media have dubbed the Google tax, was introduced in 2015 to dissuade and counteract contrived arrangements used by large multinational groups that divert profits from the UK and erode the UK tax base.

The impact of digital assets and cryptocurrencies decentralised finance on taxation in various jurisdictions

Digital assets and cryptocurrencies continue to evolve by offering new services and products such as Decentralized Finance (DeFi) and non-fungible tokens (“NFTs”), but is tax legislation also keeping up to date with the ever-changing world of digital assets and cryptocurrencies?

Are you ready for the GloBE tax challenges?

On 14 March 2022, the OECD published a comprehensive commentary and illustrative examples of how implementing the Global Anti-Base Erosion Model Rules (GloBE rules) could look. In this blog, we discuss the GloBE rules and examine how the rules apply and filing requirements. On 20 December 2021, the OECD published model rules that member countries […]

Environmental tax pillar in the environmental, social, and governance system

The information regarding environmental taxes paid by an organisation, as well as the actions taken to mitigate the impact on the environment could be included in environmental, social, and governance (ESG) reporting. Environmental reporting in total is an important element for parties to consider when doing business. Along with environmental reporting, environmental taxes play a […]

Tax compliance and incentives during martial law in Ukraine

A crucial number of Ukrainian companies (including subsidiaries of international enterprises) experienced negative business and financial impacts as a result of the Russian invasion of Ukraine which started on 24 February 2022. The urgent relocation of staff to other regions of Ukraine and abroad, interruption of access to internal databases, IT systems, and paper documents […]

The Anti-Tax Avoidance Directive II: Will other jurisdictions follow the UK’s lead?

ATAD II is the EU translation of BEPS Action 2, the part which is focused on the ability of taxpayers to design situations of double non-taxation or heavily reduced taxation by exploiting hybrid mismatches. They apply to mismatches between the EU Member States, the UK, Mexico, Australia, New Zealand, and third countries. This legislation has […]

Compliance bulletin helps businesses in Mexico

Mazars experts around the world deliver tailored services in audit, accounting, tax, financial advisory, consulting, and legal services. In Mexico, local experts have created a compliance dashboard with news items to help guide businesses as they navigate issues related to finance, tax, legal, and labour updates. With the global economy recovering from Covid-19, new government-required procedures […]

Brexit impact on in/outbound payments

When the UK finally left the EU ended on 31 December 2020, the application of provisions that have been beneficial to cross-border payments within the EU ceased, or will cease to apply. The elimination of withholding taxes, formerly part of these provisions, means companies with cross-border dividend, interest and royalty payment flows to or from […]