IAS accounting requirements for Pillar 2: GloBE for periods ending 31 December 2023

IAS accounting requirements for Pillar 2: GloBE for periods ending 31 December 2023

Background to Pillar 2 (GloBE)

Part of the ongoing work of the OECD to combat tax avoidance and targeted at low tax jurisdictions, the Pillar 2 – GloBE rules will apply to large organisations (>€750m of global revenue) with each country having its own rules implementing some form of 15% minimum tax, or otherwise risking that an equivalent amount will be charged by other group entities in respect of that country’s profit.

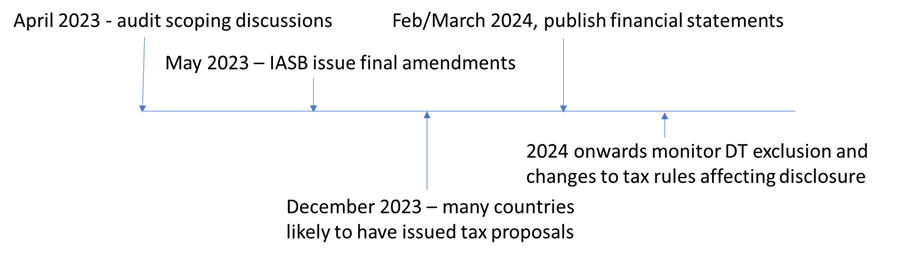

Each country will have a different version of legislation all based on a Model text. Implementation dates start from as early as accounting periods beginning 1 January 2024 and although the first reporting for Pillar 2 – GloBE is not until 30 June 2026, there are accounting disclosures that will be required in IAS reporting accounts for periods ending 31 December 2023 for many jurisdictions.

IASB consultation on IAS 12

The IASB has now completed a consultation on proposals for disclosure of the effects of Pillar 2 – GloBE and has agreed to finalise amendments to IAS 12 by the end of May 2023.

As countries look to finalise changes to their tax rules in response to Pillar 2 – GloBE, it is worth considering what the IASB proposals would mean given the different ways in which local country rules may change.

IASB proposals in a nutshell

- Calculate an IAS 12 effective tax rate (“IAS 12 ETR”) by country and disclose this.

- Comment, to the extent possible on where this ETR may differ from the Pillar 2 – GloBE ETR

- If the country has an IAS 12 ETR of less than 15% but no top-up tax is expected

- If the country has an IAS 12 ETR of greater than 15% but top-up tax is expected

- Provide a “temporary” exclusion from reporting deferred tax on tax changes designed to implement Pillar 2.

Groups will need new procedures and controls to manage the new reporting requirements.

An example of IASB proposals

It looks likely that it will be necessary to disclose the IAS 12 effective tax rate, including movements in deferred tax except any movements relating to Pillar 2 implementation rules.

This is the key area of uncertainty remaining. The notes on tax law to which the exclusion requires (Note 2 to the consultation on p.15 states):

“This Basis for Conclusions refers to tax law enacted or substantively enacted to implement the Pillar Two model rules, including tax law that implements qualified domestic minimum top-up taxes, and the income taxes arising from it, as ‘Pillar Two legislation’ and ‘Pillar Two income taxes’.

In the example below, we have assumed Singapore make changes which do not meet the definition, and so deferred tax is required, and Bermuda substantively enact changes which do meet the requirements and so no deferred tax is required.

| US | UK | Germany | Singapore | Bermuda | |

| Profit | 1 000 | 500 | 300 | 400 | 600 |

| Current tax | (280) | (125) | (90) | (20) | 0 |

| Deferred tax | 50 | 60 | (40) | (50) | 0 |

| Tax | (230) | (65) | (130) | (70) | 0 |

| IAS 12 effective tax rate | 23% | 13% | 43% | 18% | 0% |

Notes

- US proposed 28% tax rate and a small utilisation of deferred tax liability

- UK current tax rate of 25% with utilisation of deferred tax liability

- German current tax rate of 30% and setup of a deferred tax liability

- Singapore incentive rate of 5% for 2023 and 2024 and setup of deferred tax liability assuming a 2025 rate enacted of 15%, assuming not a Pillar 2 tax and so deferred tax is set up at the new rate

- Bermuda current rate of 0% and setup of deferred tax liability assuming 2024 rate enacted of 15% but as a Pillar 2 tax and therefore deferred tax is not required to be set up

Additional disclosure

It is not clear yet how much work would need to have been done on assessment of the Pillar 2 – GloBE ETR for these jurisdictions before it is necessary to comment on which:

- IAS 12 ETR below 15% will probably not have top-up tax in 2024 – in our example, the UK

- IAS 12 ETR above 15% will probably have top-up tax in 2024 – in our example, Singapore.

Given that some of the analysis will depend upon whether deferred tax is required, or if the exclusion applies, we anticipate there will be further guidance from IASB on what exactly constitutes a tax that needs to be ignored for deferred tax purposes vs a rate change which needs to be reflected. Groups impacted would need to make sure they are comfortable with their application of this guidance.

We expect many groups to be reviewing their Country by Country Reporting tax returns in 2023 to determine readiness for Pillar 2 – GloBE with this work feeding into the disclosures required.