Migrants and refugees have employment rights and obligations in Uruguay

Migrants and refugees have employment rights and obligations in Uruguay

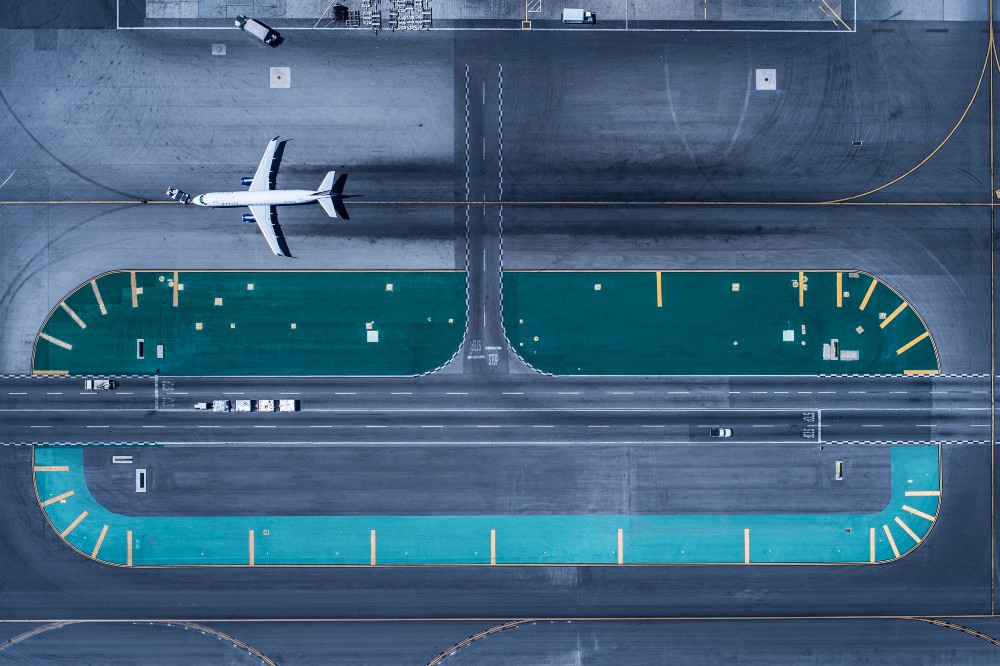

As Covid restrictions begin to lift there will inevitably be increased movement of workers across borders. This brings back into focus a range of global mobility and tax considerations for businesses and individuals. Examples include work permits, visas, payroll and social security amongst other issues. Below is a snapshot of some pints concerning Uruguay to add to our previous comments on Mauritius. Please watch out for our further coverage of global mobility issues in other countries and regions.

This article is aimed at entrepreneurs and companies that are relocating their business or expanding into Uruguay. We briefly explore the rights and obligations that migrants and refugees have in the workplace environment in Uruguay.

Migrants: Foreign migrants who work in Uruguay have the same rights and obligations as nationals following current regulations. In the situation where the individual does not have an identity card, the employer may also hire a foreign worker as long as the foreign worker can prove that they are processing an application for temporary or permanent residence. Depending on the case, it is likely the relevant proof will be in the form of a certificate from The National Directorate of Migration – Ministry of the Interior. This certificate will be valid for a period of six months from the date of its issuance.

It should be borne in mind that the authorities of Uruguay do not issue any certificate under the name of “Work Permit”.

Refugees: Refugee applicants who have not yet obtained an Uruguayan identity card may be hired to work in a labor dependency relationship provided that they prove their status as refugee applicants in the country with the current certificate issued by the General Directorate for Affairs Consular and Liaison – Ministry of Foreign Relations.

This certificate will be valid for a period of six months from the date of its issuance.

Employer: When hiring a migrant or refugee worker, the employer must proceed as for any other worker of national origin, registering him/her with the pertinent bodies:

- Social Security Bank (Banco de Previsión Social – BPS) ; with an identity card number or, failing that, with a Passport number, or an identity document from the country of origin in case the residence is pending). In the event that the worker is processing the residence or refugee application, the employer must keep in his / her possession a copy of the current certificate indicated in number 1 or 2, as appropriate.

- State Insurance Bank (Banco de Seguros del Estado); (Insurance against accidents and occupational diseases.)

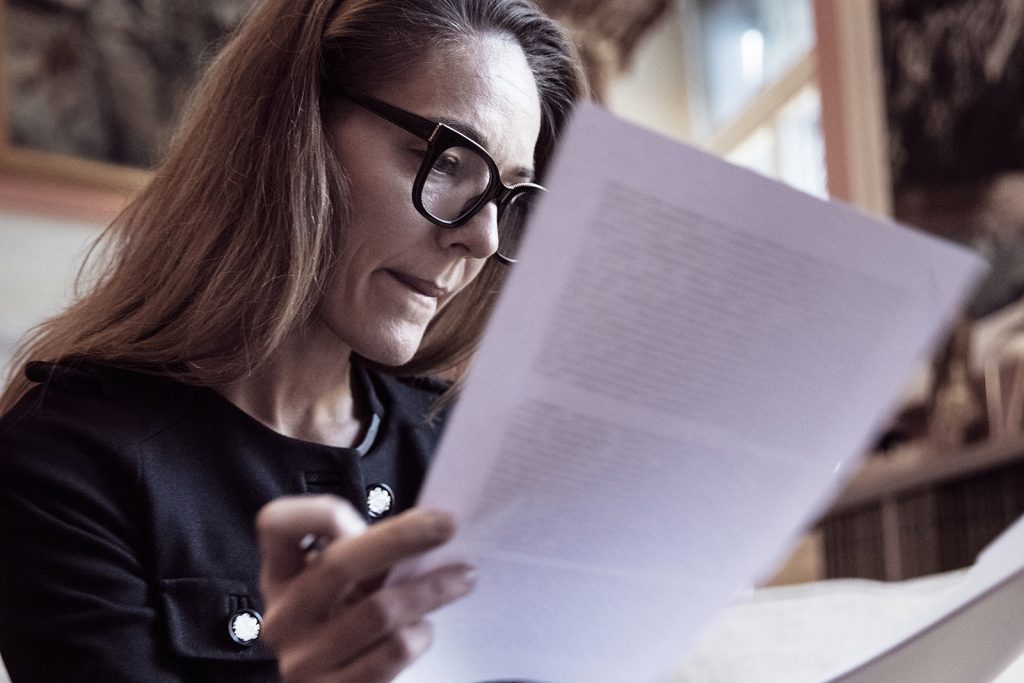

For a further discusión of the issues, please get in touch with your usual Mazars contact or Luis Ualde.

Brazil’s 2026 tax reform: preparing for transition

Starting in January 2026, Brazil will enter the transition phase of its most ambitious tax reform in decades — a structural overhaul that will reshape the taxation of goods and services. While the reform aims to simplify one of the world’s most complex tax systems, its scale and impact cannot be underestimated: it will redefine […]

The European Commission takes legal action against Sweden

The European Commission has decided to take legal action against Sweden at the EU Court of Justice. The reason? Since 2021, Swedish tax legislation has required clients to withhold 30% preliminary tax when paying foreign contractors for work performed in Sweden – if the entrepreneur (whether an individual or a company) is not approved for […]

Enhancing business sustainability through effective tax control frameworks

Sustainability challenges have become critical business imperatives in recent years. Regulators, stakeholders, investors, employees, customers – all expect a much higher degree of compliance and transparency. Businesses have got used to their performance in these areas being monitored and to being held accountable for any weaknesses. Although much of the focus on ESG (Environmental, Social […]

Tax transparency on allocation of group profits in the light of Public CbCR

Taxation has a key role for medium and large multinational companies in the process of developing a sustainable business model. Disclosure of complex tax information and transparency on profit allocation to group entities is key to this transformation process and will become a reality with new reporting standards and EU disclosure obligations. The Global Reporting […]

Proposed CAMT regulations: impact on foreign parented multinational groups

The CAMT imposes a 15% minimum tax on the adjusted financial statement income (AFSI) of large corporations and is effective for taxable years beginning on or after January 1, 2023. For these purposes, a large corporation is one with an average AFSI (as adjusted by the CAMT rules) of $1 billion over the three-year period […]

Don’t let Australian employment dream become employer’s nightmare

Since COVID-19, there has been a significant increase in demand for employees to work remotely from Australia for foreign employers. Such a relocation is often solely for the convenience of the employee to fulfil a dream of working in Australia or to return home. If you have an employee wishing to work remotely from Australia, you […]

Occasional and temporary provision and notification of services in Luxembourg

Companies established in a country of the European Union may undertake occasional and temporary activities in Luxembourg. Though such activities do not constitute a permanent establishment in Luxembourg, there are still certain formalities that need to be complied with such as: The notification of services is valid for 12 months and can be renewed […]

Tax control frameworks: an international perspective

Tax control frameworks (TCFs) are increasingly seen as an essential tax management and compliance tool for businesses of all sizes. Around the world, tax authorities are taking a stricter approach to taxation matters. At the same time, organisations like the OECD and the EU are introducing new guidelines and regulations to strengthen corporate compliance, including […]

The FIG regime: changes to the taxation of non-domiciled individuals in the UK

What is the issue? From 6 April 2025, the remittance basis of taxation for UK resident non-domiciled individuals will be abolished and will be replaced by a simplified Foreign Income and Gains (FIG) regime. There will also be changes to the way inheritance tax operates, so that it will be based on a test of residence […]

UK Spring Budget 2024

The UK Spring Budget on 6 March 2024 was relatively measured in its tax policy decisions, despite a background of falling inflation and rising tax receipts. Below are some areas of interest for globally mobile individuals, those with UK staff, and those with business and investment interests. Main measures affecting individuals Main measures affecting those […]

Italy – Extension of participation exemption (PEX) regime to non-resident (EU/EEA) companies/entities

The Italian Budget Law (Law issued on 30.12.2023, No. 213 – “Legge di Bilancio 2024”) established that Italian-source capital gains realised on disposal by EU or EEA resident entities without an Italian PE, where the disposal is of a substantial participation in an Italian company meeting certain conditions, will benefit from the participation exemption (PEX) […]

How much do you really know about your Pillar 2 disclosure obligations?

With jurisdictions still in the process of enacting local tax law to introduce Pillar 2 Global Anti-Base Erosion (GloBE) rules, groups in scope of the new regulations could be forgiven for taking a watch-and-wait approach. However, a general lack of awareness of how the rules impact entities is also hindering much-needed communication between the C-suite, […]

Moving to Mexico: global mobility tax considerations

Since 2020, as a result of the COVID-19 pandemic, Mexico has become an attractive location for certain foreigners to work remotely. However, employers have to consider numerous tax and immigration factors for their employees working remotely from Mexico. According to Mexican legislation, an expatriate is a person who is legally authorised to carry out a […]

South Africa: certain foreign employers to be required to account for payroll taxes from 2024

Currently, the provisional tax system ensures that when a non-resident employer of individuals working in South Africa has no representative employer in South Africa, their employees’ tax obligation is settled in the form of a provisional tax payment by the employee, not the employer. The requirement for an employer to deduct and remit employees’ tax […]

Expert tax relief in Sweden to be more advantageous

The Government of Sweden has submitted a bill extending the period for granting expert tax relief from five to seven years. If the Government bill is approved by Parliament, the extension will be in effect for eligible employees commencing work on 1 April 2023 or later. This article explains how the tax relief works and […]

Navigating the tax implications of remote work in Canada

As the working environment adapts to offer more flexibility with remote working options, understanding the tax nuances of cross-border remote working is becoming increasingly crucial. More than ever, employers are offering their teams the opportunity to work abroad for limited periods each year. Whether you’re a non-resident considering remote work in Canada, or an employer […]

Significant changes to Dutch expat facility

On 19 September 2023, Dutch Parliament voted for several amendments to the 30%-ruling (exempting 30% of the pay of a foreign employee working in the Netherlands) from 1 January 2024. Upon the likely enactment, this will have an impact on the tax position of existing and future expats working in the Netherlands, reducing or limiting […]

Romania prepares to enact Pillar 2 Global Anti-Base Erosion (GloBE) rules

Initiated by the Organisation for Economic Co-operation and Development (OECD) the Pillar 2 GloBE rules aim to stop tax competition between countries and to limit the shifting of profits to low-tax jurisdictions. As a result, large multinational groups (MNEs) with global annual revenue exceeding €750m will need to pay a minimum 15% tax on income […]

Telework in Europe : the new official framework agreement on social security is out

Following our previous newsletter on this topic, we are now pleased to inform you that the expert working group consisting out of 20 different EU Member States has now officially published the “Framework Agreement on the application of Article 16 of Regulation (EC) No. 883/2004 in cases of habitual cross-border telework” (hereafter referred to as […]

ESG from Transfer Pricing Perspective

This article analyses the impact of ESG on MNE tax management with a special focus on transfer pricing and business restructuring. Tax Management and ESG As stated by the UN, environmental social and corporate governance (ESG) is not only an issue that concerns individuals but also a strategic priority of multinational enterprises (MNEs), investors and […]

French landmark decision on the “beneficial owner” concept for tax treaty purposes

A landmark decision on beneficial ownership could significantly impact the French tax authorities’ approach to tax audits concerning royalties. In its decision on French company Sté Planet dated 20 May 2022, the French Administrative Supreme Court (Conseil d’État) ruled for the first time that when French-sourced royalties are paid to a foreign person who is […]

Polish Deal’s tax complexity and worsening economic conditions force revisions

A package of significant tax legislation changes came into force in Poland with effect from 1 January 2022. Dubbed the Polish Deal, these changes were intended to ‘tighten up the tax system’ and deliver a more progressive tax framework. However, they primarily involved a greater burden on a large number of taxpayers, which has subsequently […]

Spanish Supreme Court allows tax benefit to company directors

A Spanish Supreme Court Ruling on 20 June 2022 effectively reverses the decision by the Spanish tax authorities to remove the tax exemption for company directors for works carried out abroad(1). In its ruling, the Supreme Court considers that directors and board members can apply the exemption, provided that requirements set out in Article 7.p) […]

New CEE tax guide outlines fundamental changes and long-term trends

Providing information on taxation in 22 Central and Eastern European (CEE) states, the latest Mazars CEE tax guide analyses long-term taxation trends and fundamental tax regime changes in each country, both now and in previous years.

The Google tax: The UK story, 7 years later

The Diverted Profits Tax (DPT), or what the media have dubbed the Google tax, was introduced in 2015 to dissuade and counteract contrived arrangements used by large multinational groups that divert profits from the UK and erode the UK tax base.

The impact of digital assets and cryptocurrencies decentralised finance on taxation in various jurisdictions

Digital assets and cryptocurrencies continue to evolve by offering new services and products such as Decentralized Finance (DeFi) and non-fungible tokens (“NFTs”), but is tax legislation also keeping up to date with the ever-changing world of digital assets and cryptocurrencies?

Are you ready for the GloBE tax challenges?

On 14 March 2022, the OECD published a comprehensive commentary and illustrative examples of how implementing the Global Anti-Base Erosion Model Rules (GloBE rules) could look. In this blog, we discuss the GloBE rules and examine how the rules apply and filing requirements. On 20 December 2021, the OECD published model rules that member countries […]

India: Most Favoured Nation Clause causes controversy

India has signed double tax avoidance agreement (DTAA) treaties with several countries and entered into a protocol, inter-alia, containing the Most Favoured Nation (MFN) clause with 13 countries including France, Belgium, Spain, Sweden Switzerland, and the Netherlands. The MFN clause usually states that if, after date of entry into force of the tax treaty between […]

French landmark decision on foreign tax credit imputation for capital gains on shareholdings: an extension to dividends?

In a decision “Air Liquide” dated 15 November 2021, the French Administrative Supreme Court (Conseil d’Etat) ruled for the first time that French resident companies realising capital gains upon the alienation of eligible participation (titres de participation – generally presumed for a 5% interest held for a minimum two-year period) in a foreign company are […]

The proposed new EU “Unshell” directive

On 22 December 2021, the European Commission published a number of Directives impacting a wide variety of corporate structures and taxpayers. One of these Directives is “laying down rules to prevent the misuse of shell entities for tax purposes and amending Directive 2011/16/EU’’, commonly referred to as ATAD3 or the Unshell Directive (see here) (hereinafter […]

Corporate income tax changes in Poland for 2022

As of January 1, 2022, significant changes concerning the Polish tax system called the Polish New Deal came into force. These amendments also include Corporate Income Tax (CIT). Changes in withholding tax The major changes concern: Implementation of pay and refund mechanism (mechanism introduced in 2019 and suspended until the end of 2021) as the basic mechanism of […]

New tax rules in Luxembourg impacting cross-border workers and PEPPs

Guidelines on the taxation of cross-border workers during the Covid-19 pandemic and an update on PEPP as defined in the latest budget laws in Luxembourg.

MNEs subject to 15% minimum tax rate from 2023: main OECD provisions and EU implementation proposals now available

The OECD two-pillar approach In October 2021, the OECD’s 137 Inclusive Framework members agreed to adopt a two-pillar approach to address the tax challenges of the digital economy. Pillar I provides for new profit allocation and nexus rules for MNEs with a turnover greater than EUR 20 billion and profit before tax margins of 10% […]

Changes to Belgian special tax status expected in 2022

The Belgian government has approved a draft bill in which changes for the new Belgian special tax status for foreign executives and specialists are embedded. The limited duration of the tax benefits, the minimal remuneration threshold, and the ‘30%-rule’ are the most profound changes. The changes will be effective from January 1, 2022. As a […]

Greece’s beneficial tax regime for foreign residents

In December 2020, Greece introduced tax incentives to attract foreign tax residents. Specifically, the provisions of Article 5C of the Greek Income Tax Code (ITC), which came into force on 1 January 2021, stipulate that foreign employees or foreign freelancers becoming Greek tax residents can enjoy a 50% tax exemption from income derived in Greece […]

Improved tax flexibility for Belgian / Luxembourg cross-border workers

Due to the Covid-19 pandemic, many Belgian tax residents working in Luxembourg were no longer able to travel since remote working/home working was recommended or mandatory, based on governmental rules. As such, ‘the 24-day rule’ (whereby taxation of days working in Belgium are treated as fully taxable in Luxembourg and not in Belgium, provided the […]

Impact of the UK’s new Health and Social Care Levy Bill on expatriates

In response to the unprecedented spending on public services during the recent pandemic, the UK government has introduced a 1.25% health and social care levy applicable to every person liable to National Insurance Contributions (NIC), including self-employed individuals and internationally mobile employees (IMEs). Where employees are concerned, employers will also be required to pay the […]

The Anti-Tax Avoidance Directive II: Will other jurisdictions follow the UK’s lead?

ATAD II is the EU translation of BEPS Action 2, the part which is focused on the ability of taxpayers to design situations of double non-taxation or heavily reduced taxation by exploiting hybrid mismatches. They apply to mismatches between the EU Member States, the UK, Mexico, Australia, New Zealand, and third countries. This legislation has […]

Tax updates in the context of the digital economy

Key milestones are being reached in the digital economy in 2021. In this post, we review the most recent legislation and provide insight on how to keep up with the tax aspects of this fast-developing topic. Digital commerce is increasing globally as the world becomes ever-more interconnected. More and more companies are exclusively active in […]

Is the new two-pillar solution to address tax challenges suitable for African countries?

This new solution is expected to reallocate more than $100bn of profit annually to market jurisdictions. However, this raises the question, to what extent emerging economies, and more specifically, African countries, will be entitled to levy taxes on profits generated by multinational enterprises from their markets? This source and others are sorely needed by these […]

Recent Tribunal ruling on the taxation of ESOPs (Employee Stock Option Plans) in India

In accordance with OECD guidelines, the taxability of ESOP in India depends on where employment is exercised and the period of service for which ESOP has been granted.

Tax issues arising from corporate amalgamations in Hong Kong

In June 2021 Hong Kong finalised legislation codifying the Inland Revenue Department’s tax assessment practice relating to corporate amalgamations. For qualifying companies, it is possible to elect (within one month of the amalgamation) for special tax treatment for pre-amalgamation losses, succession to business assets, amongst other areas. While the new legislation provides greater certainty on […]

Switzerland is an attractive business hub. What is their secret?

Choosing a business location involves many considerations, with tax being only one of them. Nevertheless, tax is a consideration. Below is a note commenting on the attractions of Switzerland as a business location. There may of course be other locations that should be considered. Switzerland attracts global business, research, and innovation, and maintains the high ground […]

Tax aspects of opening a business hub in Asia

The Asian Development Bank has forecast that developing Asia’s growth is forecast to rebound to 7.3% in 2021 and 5.3% in 2022. This compares to 4.2% and 4.4% respectively for Europe (see here) and 6.9% and 3.6% for the US (see here). Businesses already with a footprint in the Asian region will be gearing up their operations to deal with the region’s expected […]

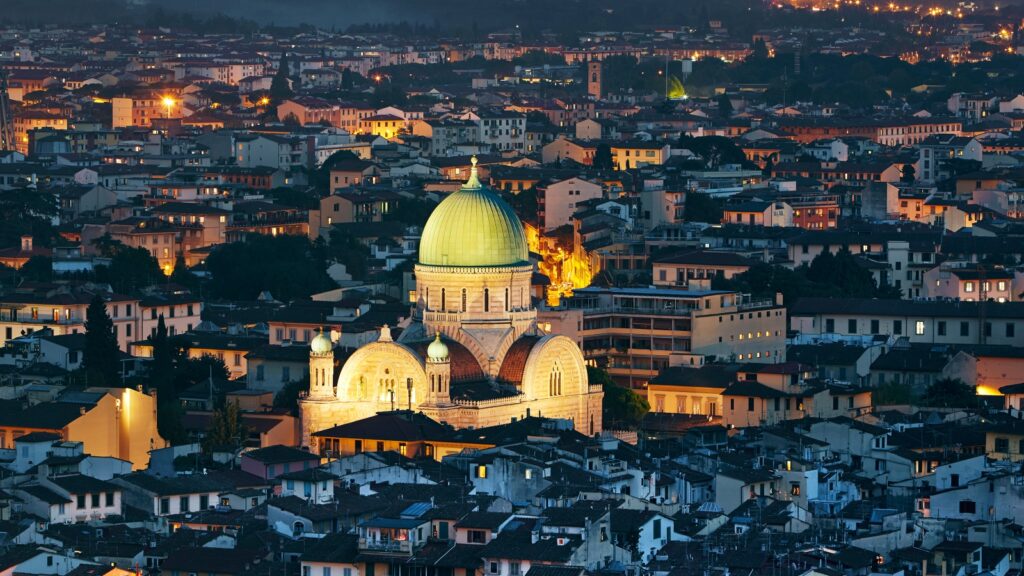

Challenges of global mobility – focus on Mauritius

Global mobility is a significant advantage in a world where all countries are connected by monetary flow, means of transports and digital communication. A comprehensive global mobility strategy takes time, teamwork, and careful thought. The main challenges faced when designing a global mobility program are payroll, tax issues and laws, and compensation among others. It […]

Special Purpose Acquisition Company (SPAC) – Is this tax vehicle a blank check?

Is it a bird? Is it a plane? Why is a SPAC considered a ‘high flying’ concept and what tax issues need to be considered to reap the benefits and avoid the pitfalls of a SPAC transaction? In this article, we provide a brief overview of SPACs, the particular tax issues relevant to the US […]

Updated OECD guidance on the impact of Covid-19 for cross border workers

In April 2020 the OECD issued guidance on the impact of Covid-19 on double taxation agreements (DTA) and their application to cross border workers. In January 2021 they updated this guidance. This guidance is necessary as some cross-border workers have been stranded in a country that is not their normal residence, and double taxation could arise without applying a practical approach to the […]

The new great debate: minimum global corporate income tax?

The new U.S. Secretary of Treasury, Janet Yellen, has garnered this week’s tax spotlight with her support and request for the world to support a minimum global corporate income tax. This would apply to the largest and most profitable businesses (numbering around 100), with the suggestion that the minimum rate to be applied to be […]

Why Czech Republic’s tax system is attractive for expatriate employees?

Tax reform continues to come in waves across the globe. One common theme of many reforms is tax breaks for low to mid wage earners and surprising tax hikes for high wage earners. This trend seems to be consistent with the latest out of the Czech Republic. New changes to the Czech tax law effective […]

How to attract private capital to fund the new American Jobs Plan?

On March 31, 2021, the Biden administration released The American Jobs Plan, which detailed, among other critical items, the need for infrastructure improvements to enhance America’s competitiveness and to create well-paid American jobs. For this to be successful in attracting needed private capital, the existing regulations concerning Real Estate Investment Trusts (REIT) and Foreign Investment in […]

Impact of Covid-19 on personal income tax and permanent establishments in Singapore (Part 2)

The Covid-19 pandemic has resulted in unprecedented disruptions across multiple countries and economies in the world. In addition to adversely affecting the world economy, the restrictions placed on travel could have personal income tax implications for individuals and permanent establishment risks for businesses. This article provides an insight into the tax considerations in respect of the current crises with focus on the Singaporean personal income tax regime and the possible creation of permanent establishment risk. Permanent Establishment considerations […]

Impact of Covid-19 on personal income tax and permanent establishments in Singapore (Part 1)

The Covid-19 pandemic has resulted in unprecedented disruptions across multiple countries and economies in the world. In addition to adversely affecting the world economy, the restrictions placed on travel could have personal income tax implications for individuals and permanent establishment risks for businesses. This article provides an insight into the tax considerations in respect of the current crises with a focus on the Singaporean personal income tax regime and the possible creation of permanent establishment risk. Taxation […]

Tax reclaim opportunities regarding withholding taxes in Germany

As a result of a number of recent cases there are tax reclaim opportunities for non-German investors in German companies that have suffered withholding taxes (WHT), subject to meeting certain conditions. Points to consider A complete or partial WHT relief may now be possible: i) where there is no Double Taxation Treaty (DTT) in place […]

Governmental proposal for redraft of German “Anti-Treaty Shopping Provision”

Background On January 20, 2021, the German government published a draft law for the Gesetz zur Modernisierung der Entlastung von Abzugsteuern undder Bescheinigung der Kapitalertragsteuer (Act for modernization of the relief of withholding taxes and the certification of capital gains tax, AbzStEntModG). Among other things, this draft contains a new wording proposal of the so-called “Anti-Treaty Shopping” provision in Sec. 50d (3) German Income Tax Act (ITA), in order to comply with European law requirements. Sec. 50d (3) […]

New German tax developments regarding intellectual property (IP)

Decree of the Federal Ministry of Finance dated 11 February 2021 – Remuneration of the temporary transfer and the disposal of rights which are entered in a German public register. Further information on German tax developments relating to intellectual property (IP) registered in Germany has been released by the German Authorities. This helps to clarify how the German taxing right can apply to non-German users or vendors of this IP. This […]

Covid-19 and the impact on taxation of individuals and permanent establishments in Nigeria

world. In addition to adversely affecting the world economy, the restrictions placed on travel could have personal income tax implications for individuals and permanent establishment risks for businesses.

Changes to interest deduction limitation rules

The EU Anti-Tax Avoidance Directive (ATAD), contains five legally binding anti-abuse measures, which all EU member states are required to apply against common forms of aggressive tax planning. The Directive includes an exit tax, a general anti-abuse rule, controlled foreign company rules, measures to tackle hybrid mismatch arrangements, in addition to an interest limitation rule. We […]

EU-UK social security protocol and its implications

On 24 December 2020, a draft protocol on social security co-ordination for EU-UK cross border working arrangements that start from 1 January 2021 was published. The draft protocol contained an article covering detached workers, i.e. employees who normally work in one EU member state/the UK who are sent to work in the UK/an EU member […]

Corporate income tax reform: tax loss relief limited to 50% of annual profits

The Dutch government has provided further details concerning a potential reform of the tax loss relief rules in the corporate income tax regime. The proposed amendment will mean that losses can be set off indefinitely from 1 January 2022, but the number of losses that can be set off will be capped. The government had […]

Home office: new tax and social security implications in France

With the Covid-19 crisis, working from home is expected to become the “new normal”. 2020 marks the end of many tax holidays with respect to home working arrangements within and between certain countries. We have already featured some general comments on the implication of remote working in previous blog posts; and we will regularly feature […]

Remote Worker – “necessity” or “choice”?

During the first wave of Covid-19 back in the spring of 2020, many employers found themselves dealing with the issue of “remote workers” in significant volumes, for the first time. When “working from home”, means working from home in another part of the city or the country then the issues are more likely to be […]

State tax telework developments

It seems right now that most countries around the world are busy regulating certain telework arrangements cross border with a keen focus on taxation rights. The U.S. is no different. In fact, the U.S. has the matter pending before its highest Court for review. A decision will not only impact the states named but obviously […]

The UK fiscal environment for international business following Brexit

Following the UK’s spending review statement of 25 November, there is now greater clarity on how the UK economy will be taken forward into 2021 following the Covid-19 pandemic and exit from Brexit transition. Despite incurring record UK government borrowing this year of around £395bn, the significant further borrowing to fund investment during the recovery […]

French landmark decision fighting against “commissionaire” arrangements in the digital economy

After the French government enacted a 3% digital services tax on gross income, it is now the French Administrative Supreme Court which rendered a landmark decision for international groups providing digital services in France by strongly extending the definition of permanent establishment in the presence of commissionaires. This new case law remains also relevant for […]

Welcome (bienvenidos, willkommen, karibu, bienvenue) to a world of tax incentives

The pandemic has led to many people choosing to relocate. Many are leaving densely populated cities to work remotely to where they feel are more desirable locations for themselves and family. Others are holding steadfast to their crowded city dwellings. Either way, geographies are challenged to retain (or welcome) existing residents and newcomers. Many are […]

DAC6 tightens the reigns on M&A deals across the globe

EU Directive 2018/822 or DAC 6 (acronym of “Directive on Administrative cooperation”) is in the minds of many European tax practitioners. In this article we will set out its importance for the European M&A market. Beyond this mysterious acronym, the European Union is pursuing its efforts to prevent tax fraud and tax evasion (and thus create legal and business ” fairness […]

The new year brings new social security challenges post- Brexit

What is the issue? With Brexit talks still ongoing, employers should be planning for the impact of a hard Brexit on social security coverage and benefit provision for their employees who travel between the UK and EU (including EEA & EFTA countries and Switzerland) for work. HMRC’s October employer bulletin provided a welcome update on […]

ICAP 2.0 – A solution to aggressive tax audits for MNEs during Covid-19

Governments damaged by the Covid-19 pandemic are likely to be taking a more aggressive approach in tax field audits on multinational enterprises (MNEs), at least until after their respective economy is on its way to recovering from the impacts of the pandemic. The OECD launched a pilot of the International Compliance Assurance Programme (ICAP) on […]

The future of joint tax audits beyond Covid-19

The current restrictions imposed by multiple countries to combat the Covid-19 pandemic have limited the possibilities for conducting external tax audits. However, the current pandemic and its consequences for the world economy highlight again that the number of internationally active companies is increasing. This has a significant impact on the future of tax audits. Coordinated […]