Environmental tax pillar in the environmental, social, and governance system

Environmental tax pillar in the environmental, social, and governance system

The information regarding environmental taxes paid by an organisation, as well as the actions taken to mitigate the impact on the environment could be included in environmental, social, and governance (ESG) reporting.

Environmental reporting in total is an important element for parties to consider when doing business. Along with environmental reporting, environmental taxes play a significant role when analysing how much a business spends to protect the environment and reduce its environmental footprint.

ESG background

ESG is now on everybody’s agenda, regardless of the size of the company or operational sector, and centres around financial risk.

In 2019 an EU Regulation1 introduces ESG disclosure requirements for benchmark administrators and minimum standards for the construction of the EU Climate Transition benchmark and EU Paris-aligned benchmarks.

In its communication on the European Green Deal adopted in December 2019, the EU made a commitment to review the provisions concerning non-financial reporting. The EU is planning to adopt a new Corporate Sustainability Reporting Directive (CSRD)2 by the end of the year 2022. This directive3 will promote new sets of standards regarding sustainability reporting.

To be able to meet the EU’s climate and energy targets for 2030, and to reach the objectives of the European Green Deal, investments must be directed towards sustainable projects and activities.

Therefore, companies should take into consideration the impact of all their activities, starting from the supplier through to the end of life actions and products. Individuals and stakeholders are starting to reconsider whether certain raw materials, packaging, and products are environmentally friendly and are taking into account the environmental credentials of businesses they deal with.

To help stakeholders to evaluate if a certain activity is sustainable, EU Commission introduced the Taxonomy climate[1] delegated act – see here. The EU Taxonomy is a classification system, establishing a list of environmentally sustainable economic activities. It could play an important role in helping the EU scale up sustainable investment and implement the European Green Deal provisions.

By applying the Taxonomy, operators can demonstrate that their products are environmentally friendly and that environmental standards are met, thus facilitating access to obtain sustainable finance. Investors are informed and are aware of the impact that a certain activity has on the environmental when providing that financing.

Environmental taxes may be used to influence the behaviour of producers or consumers. In order to support the transition to a climate-neutral economy by 2050 and achieve the objectives of the EU Green Deal that aims to reach a 55% net reduction of greenhouse gas emissions by 2030, environmental taxes could be a reliable revenue according to the European Environment Agency Publication on 07 February 2022[2]

Pollution taxes

Within the EU there are certain environmental taxes, known as pollution taxes, already implemented. These include packaging taxes as a result of the Waste Directive and Plastic packaging Directive, in, for example, Romania, Italy, and Spain.

These taxes are a result of the Extended Producer Responsibility policy approach (EPR – see here). In relation to the EU, operators who market packaged products in any EU country are responsible for the waste generated by the packaging or by their product. For example electric and electronic equipment, batteries or tyres in that country.

In order to minimise the taxes paid locally, companies have the option to pay directly to the state for the packaging introduced or to reduce operational costs if packaging waste is properly recovered by an authorised organisation.

Under the EPR scheme, operators pay a certain fee to organisations that implement the extended producer responsibilities (private operators), depending on the actual quantity and type of packaging used to deliver the products such as cardboard, PET, plastic, metal, aluminum, glass and wood packaging, or by the type of products in a certain country’s market. The EPR scheme is an economic instrument implemented for various types of waste aimed to reduce the amount of waste that is disposed of and increasing the use of waste as a raw material used for new products.

To reduce the environmental impact produced by certain types of plastic products, the EU issued a directive in 2019 regarding single-use plastic products (SUP), under which a new EPR policy could be developed in other to tackle the subject of plastic products that easily end up in European waters. Also, the EU now ban the importation or manufacturing of drinking straws, cutlery, plates, drink stirrers, and cotton bud sticks made from plastic.

A new contribution for non-recycling packaging plastic (plastic levy) was introduced by the EU Commission. As of 2021, a plastic levy must be paid by the Member States directly to the EU in respect of non-recyclable plastic packaging that is introduced in any EU country – by import, intra-community acquisition, or manufacturing. Every country should decide how and which operators must pay for this new plastic levy.

Operators will need to be aware of what type of plastic is used when delivering their products to the market with regard to the plastic levy now in force. Also, a certain percentage of recycled plastic could be used to reduce the incidence of tax on non-recyclable plastic.

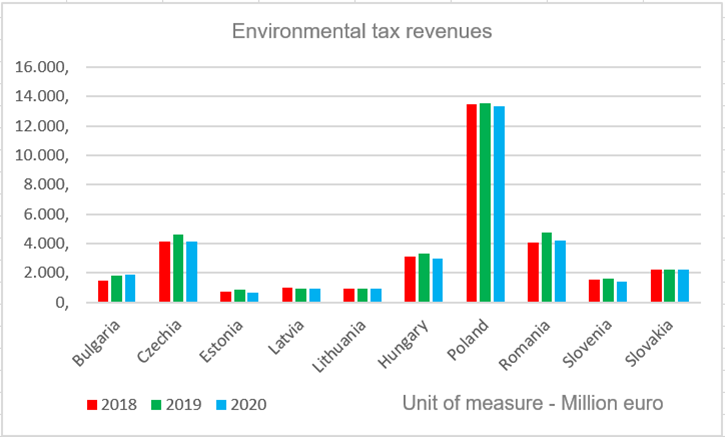

Level of environmental tax in the CEE region

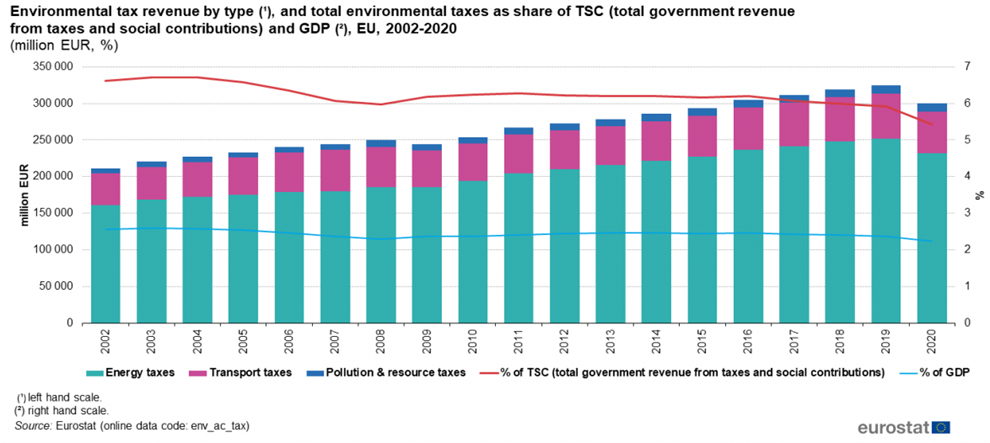

Regarding environmental tax levels within the EU, according to Eurostat, there are taxes allocated in the following areas: energy, transport, pollution, and resource. These taxes were paid directly to each country in 2020.

Taxes on energy accounted for over half of the environmental tax revenue in all EU Member States in 2020, is by far the largest source of environmental taxes in Czechia, Romania, Luxembourg, Estonia, and Lithuania, with more than a 90% share of the total environmental tax revenue.

* TSC – total government revenue from taxes and social contributions

* GDP – gross domestic product

In 2020 transport taxes were the second-largest component of the environmental tax revenue for all EU Member States, excluding Estonia.

Pollution and resource taxes account for a very small portion of the environmental tax revenue. They group a variety of taxes levied, for example, on waste, water pollution, and abstraction. In 2020 the contribution of pollution taxes was quite high in Poland.

In 2020, total environmental tax revenue in the EU amounted to €299.9 bn, representing 2.2% of EU GDP and 5.4 % of total EU government revenue from taxes and social contributions.

(source: https://ec.europa.eu/eurostat/databrowser/view/ENV_AC_TAX/default/bar?lang=en&category=env.env_eta )

The current situation is problematic for companies that will have to report data, especially in the production, retail, and transport fields, either as required by the legislation or at the request of shareholders or stakeholders. Operators, when doing business may need to appreciate their clients’ opinions on environmental issues, to better understand whether their suppliers’ activities align on environmental issues appropriately.

At the EU level, consideration is being given to what information operators should report and what are the unnecessary business costs in improving sustainability reporting.

The first set of standards would be adopted by October 2022[3].

Nevertheless, operators should begin focusing in earnest on the impact their business might have on the environment and on the costs they may encounter in adapting to climate change. As mentioned above, environmental taxes could play a significant role in reducing adverse impacts of business activity on the environment. A realignment of activities to comply with environmental responsibilities and appropriate disclosure and reporting of the expected future costs could help in maintaining a good company image.

[1] https://eur-lex.europa.eu/legal-content/EN/TXT/PDF/?uri=CELEX:32020R0852&from=EN

[2] https://www.eea.europa.eu/publications/the-role-of-environmental-taxation

[3] https://ec.europa.eu/info/business-economy-euro/company-reporting-and-auditing/company-reporting/corporate-sustainability-reporting_en