Moving to Mexico: global mobility tax considerations

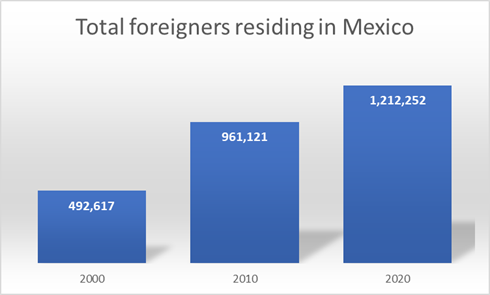

Since 2020, as a result of the COVID-19 pandemic, Mexico has become an attractive location for certain foreigners to work remotely. However, employers have to consider numerous tax and immigration factors for their employees working remotely from Mexico.

According to Mexican legislation, an expatriate is a person who is legally authorised to carry out a remunerated activity as an employee in Mexico without being a Mexican citizen. Below we look at how this applies to an expatriate employee working for a Mexican employer or a non-Mexican employer.

Working for a Mexican entity

Any foreigner who moves to Mexico to be hired by a Mexican company must comply with an immigration process to obtain a working visa and be authorised to undertake economic activities. Subject to this, any foreigner can be hired without proof of legal residency in the country.

General Population and Housing Census. National Institute of Statistics and Geography (INEGI)

The period for which a legal temporary visa is granted in Mexico may vary depending on the type of such visa. There are two types of permits: those that are granted for an uninterrupted period of no more than 180 days from the date of entry and those granted for a period of no more than 4 years as long as there is an offer of employment.

If the intention is to obtain a permanent permit, expatriates must prove that they have a job offer that specifies the activity they will perform, the length of time they will be required to be in Mexico, as well as the general details of the company where they will be working.

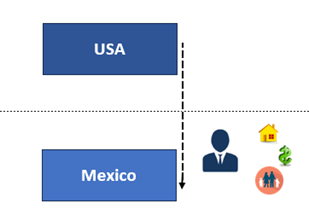

Working for a foreign company

On the other hand, foreigners that are moving to Mexico to live and work for a foreign company will need a type of residence document (temporary or permanent) other than a work visa, which means that they would need to comply with the migration regulations to enter and stay in the country legally, but will be unable to work for a Mexican employer .

What employers need to be aware of in such cases is that when foreigners stay in Mexico for more than 183 days in a 12-month period, whether consecutive or not, depending on the activities they carry out, the foreign employer could be considered to have a permanent establishment in Mexico. If there is a permanent establishment, there may be an exposure to Mexican taxes on the employer’s activity in Mexico.

How do foreigners pay taxes in Mexico?

Once the foreigners have obtained legal authorisation to stay or work in Mexico, the next step to determine their Mexican tax obligations is to identify the individual’s tax residency. An individual’s tax residency is determined considering the follow:

- The foreigners’ domiciliation

- The source of their vital economic interests

- Their habitual address

- Their nationality

- If it is still not possible to determine an individual’s tax residency, the tax authorities of Mexico and the other relevant jurisdiction may agree the determination of the individual’s residency

In assessing tax residency, it will be important to consider whether the terms of a double tax agreement between Mexico and the other relevant jurisdiction applies.

Tax residency in Mexico

Expatriates are generally considered as tax residents in Mexico if they have established their residency in the country. If the expatriates also have a residency in another country, they may still be considered residents in Mexico if more than 50% of their total income in a year comes from activities carried out in Mexico or if they have the center of vital economic interests in the country.

Where an expatriate is considered tax resident in Mexico, they will be obliged to report their total global income in Mexico, regardless of whether it comes from other countries. In addition, the expatriate will be obliged to register in the Federal taxpayer’s registry and obtain an electronic signature.

The income that expatriates obtain for professional activities carried out in Mexico is subject to the payment of the income tax (IT) to be deducted by the employer from the individual’s pay. The tax is determined based on a progressive income above a specific threshold and is deducted on a monthly basis. In addition, expatriates who have the status of Mexican tax residents are obliged to file the annual income tax return.

For the income received from activities carried out in other countries, expatriates will be obliged to file monthly returns and pay the corresponding tax.

Mexican employers will also need to register their expatriate employees with the Mexican Social Security Institute (IMSS) and issue the pay slips that support the income from the activities carried out in Mexico. This may mean an expatriate will need to make social security contributions in both Mexico and their home jurisdiction, unless there is an agreement between the two countries mitigating this.

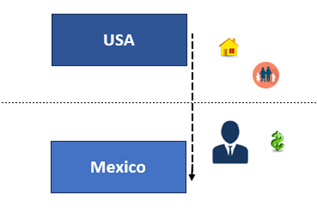

Resident abroad with income sources of wealth in Mexico

If the expatriates are tax residents abroad and obtain income from activities carried out in Mexico as part of a temporary assignment in the country for less than 183 days, they will be considered as residents abroad (i.e. not tax resident in Mexico) with income from a source of wealth in Mexico.

Expatriates must ordinarily pay taxes on income earned in Mexican territory in a monthly basis at the applicable withholding rates as follows:

- Exempt for the first $125,900.00 pesos

- Rate of 15% on the excess of the above amount up to $1,000,000.00 pesos

- Rate of 30% on income exceeding $1,000,000.00 pesos

If the employer decides to cover the tax payable on behalf of the expatriate, this amount will be considered as additional income and will form part of the basis for determining the tax.

In this case, the tax paid monthly is considered definitive, and the expatriate will be not required to file a Mexican annual income tax return.

However, if the expatriates perform services in Mexico for a period of less than 183 calendar days, whether consecutive or not, over a 12-month period the income obtained from the performance of services in Mexico Iill be exempt from the payment of Mexican income tax.

Foreigners in Mexico working for foreign companies

In the case of foreigners working in Mexico for foreign companies without a permanent establishment in Mexico, they could be considered to not be in possession of a source of wealth in Mexico as long as their stay in the country does not exceed 183 days. As mentioned before, a regular permanent or temporary visa may be applicable in this circumstance.

In case foreigners have an accident or illness, they must be capable of affording healthcare as social security in Mexico only applies to workers with work permits.

Social security

Regarding the social security, if an expatriate foreign employee provides services to a Mexican company and receives remuneration, they are entitled to be affiliated with the Mexican Social Security Institute (IMSS), Otherwise, if the employee is paid by a foreign company directly, they are not entitled to the social security service.

Mexico has social security treaties with Spain and Canada, so it would be necessary to confirm if there are specific provisions that may be applicable.

Conclusion

With the prospect of moving to Mexico as an individual for work or tourism, tax and immigration are key elements that need to be considered. One of the most important factors to assess is the employment conditions and length of stay, as this can determine the costs and administrative procedures relevant to the individual and ultimately the success of the expatriate’s assignment in Mexico.