Turkey issued the first legislation in relation to the Mutual Agreement Procedure (MAP)

With Law No. 7338 on Turkish Tax Procedure Law (TPL) and Amending Certain Laws (“Law No. 7338”) published in the Official Gazette dated October 26, 2021, a domestic regulation was made for the first time regarding the mutual agreement procedure (MAP) in Turkey. The Turkish Revenue Administration (TRA) aims to eliminate uncertainties regarding the application of MAP with these regulations, thus making the procedure more effective and consequently increasing the success of the MAP process.

Why MAPS are higher on agenda?

The MAP article in tax conventions allows designated representatives (the “competent authorities”) from the governments of the contracting states to interact with the intent to resolve international tax disputes. These disputes involve cases of double taxation (juridical and economic) as well as inconsistencies in the interpretation and application of a convention. Since most instances of double taxation are dealt with automatically in tax conventions through tax credits, exemptions, or the determination of taxing rights of the contracting states, the majority of MAP cases are situations where the taxation of an individual or entity is unclear[1]. Transfer pricing cases are the best example of economic double taxation and are among the top international tax disputes subject to MAP. One of the action plans of the OECD BEPS project is to make dispute resolution more effective (Action 14). To be fully compliant with an effective dispute resolution mechanism under the Action 14 Minimum Standard, Turkey signed the Multilateral Instrument (MLI).

Turkey Inventory on MAP

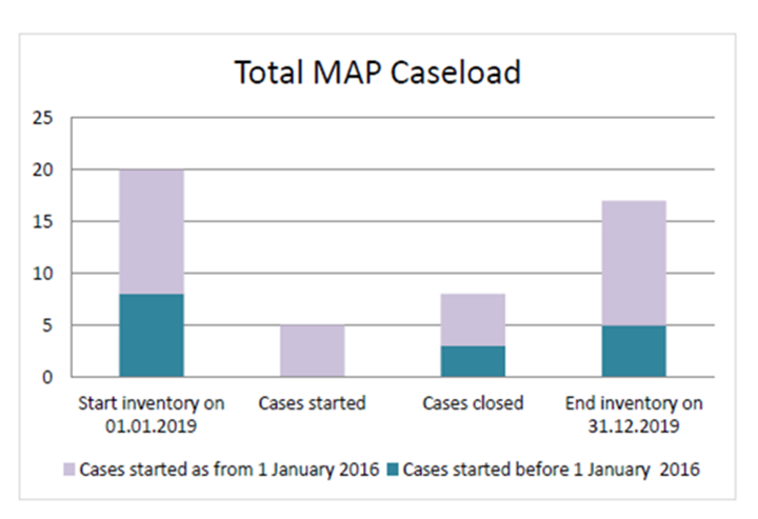

Turkey has a treaty network with over 90 countries. In all these Double Tax Treaties (DTT), there is an article (article 25) for the Mutual Agreement Procedure. Although Turkey meets the requirements regarding availability and access to MAP, there was no domestic regulation until 2021 but only Guidance on MAP published by the TRA in 2019. Due to a lack of domestic regulation and uncertainties regarding the MAP processes, MAP was not considered an effective dispute resolution mechanism in Turkey. Therefore, the historic use of MAP in Turkey is also low compared to most European countries. The below table illustrates the latest inventory level of Turkey in relation to MAP[2].

Application Procedures

The Law clarifies that the taxpayers should apply to the TRA for a MAP in due time stated in the related double tax treaties. However, where there is no time limitation in the double tax treaty or a lack of any reference to a time limit in domestic legislation, MAP application should not be made later than three years following the formal date that the taxpayer is informed of the tax outcome with which they disagree.

There are two essential effects of MAP in terms of other domestic procedures.

Firstly, the MAP application ceases the period of limitations provided under the Turkish Procedural Law regarding the taxes and penalties subject to the application. However, when the taxpayer rejects the MAP conclusion, the period of limitations recommences.

Secondly, the MAP procedure also halts the period of filing a lawsuit which aims to solve the dispute resolution through the local legislation.

Finalization Procedures

Once the agreement between TRA and the competent authorities has been finalized, the taxpayer is notified in writing of the decision and is provided with an explanation of the result. Upon the acceptance by the taxpayer within thirty days, written confirmation of the agreement is exchanged between the administrations and provided to the taxpayer.

The decision between TRA and the competent authorities is not binding for the taxpayer. If the taxpayer wants to reject the decision (there is always such a right) then no notification can be done by the taxpayer. In the same way, if no notification is made, the taxpayer will be deemed to have rejected the agreement.

It is also important to note that the result will be binding for any court cases pending the outcome of MAP if the taxpayer accepts the MAP result.

Conclusion

TRA needs to increase the level of use of MAP in cross border tax dispute cases in accordance with the minimum standard of Action 14 of the BEPS Action Plans. With the help of this new domestic Law which brings clear guidance concerning the process, it is our expectation that the taxpayers can re-evaluate their use of the Turkish MAP as part of their tax risk management strategy for effective tax dispute resolution.

[1] OECD, MEMAP (Manual on effective Mutual Agreement Procedure), 1.2

[2] https://www.oecd.org/tax/dispute/2020-map-statistics-turkey.pdf

VAT and transfer pricing adjustments: the worst of both worlds?

In due course, the EU Court of Justice (ECJ) may shed some light on the VAT intricacies of transfer pricing (TP) adjustments. In Arcomet, the Bucharest Court of Appeals asked the ECJ whether the amounts included in yearly equalisation invoices to ensure arm’s length pricing within a group, constitute payment for VAT relevant services. Should […]

The current transfer pricing environment in the banking and asset management sector, and the importance of regular review

The financial services sector remains firmly in the spotlight of global tax authorities and prudential regulators. Whether it is HMRC in the UK or the Internal Revenue Service (IRS) in the US, understanding how money moves between regulated entities and overseas affiliates is a hot topic. In this respect, regular reviews of how arrangements are […]

Transfer pricing legislation in the Republic of Moldova

For the first time, the Republic of Moldova has introduced the Tax Code provisions on transfer pricing and the arm’s length principle. These measures are expected to apply from 1 January 2024, with an aim to bring local legislation closer to both the EU law and the recommendations of the Organisation for Economic Co-operation and […]

ESG and financial transactions from a transfer pricing perspective

In 2021, the European Central Bank (ECB) published its final guide on climate-related and environmental risks for banks. It aimed at enhancing the industry’s awareness and preparedness for managing climate-related and environmental risks. The risks mentioned are commonly related to two main types: physical risk and transition risk. They have an impact on both economic […]

Protecting reputation and managing communication on tax matters for ESG ratings and Pillar 2 disclosures

Over the last decade, the Organisation for Economic Co-operation and Development (OECD) and the European Union (EU) have made significant developments regarding tax transparency regimes and the exchange of information between tax authorities. However, these developments are being taken further in the drive for increased transparency and public availability of such information, particularly in relation […]

What is the future of taxation in Europe: questioning the usefulness of all anti-avoidance measures

Pillar 2, which is the Global Anti-Base Erosion Rules (GloBE) minimum tax project, and the BEFIT initiatives are considered likely to reduce some tax planning opportunities respectively at worldwide and EU levels, and thus reduce the need to address them through anti-avoidance rules. Therefore, it may be reasonable to consider whether all these anti-avoidance rules […]

What is the future of taxation in Europe: impact on multinational enterprises

Initiatives mentioned in the previous article already affect and will further affect multinational companies in a significant way. The first step for multinational companies to consider is how to build stakeholders’ understanding of the impact these changes in domestic legislation will have on the business. In the case of Pillar 2, for example, this means […]

What is the future of taxation in Europe: state of play for ongoing initiatives

The international tax landscape has undergone major changes over the past few years which is set to have a significant impact on the overall tax architecture. At both international and European Union (EU) levels, several initiatives have been pursued aimed at aligning tax collection with the location of economic activity and achieve a minimum level […]

The impact of rising interest rates on transfer pricing

With rising inflation and multiple key interest rate increases, multinational enterprises should consider reviewing the prices of their intercompany financing transactions, which may no longer align with the arm’s length principle. The quick rise in interest rates may have created significant divergence between the prices applied by a multinational enterprise on its intercompany financing transactions […]

Where is the UK Diverted Profits Tax and the Profit Diversion Compliance Facility now?

On 7 February 2023, the UK tax authority HM Revenue & Customs (HMRC) released its Transfer Pricing and Diverted Profits tax statistics for the 2021 – 2022 tax year. The statistics clearly demonstrate that both transfer pricing and Diverted Profits Tax (DPT) continue to yield significant income for HMRC and that these areas are likely […]

Can Turkey make progress on transfer pricing audits?

National differences and approaches to transfer pricing are evident all over the world. In particular, tax jurisdictions in developed countries have now taken quite advanced steps in approaching complex transfer pricing situations from a technical debate perspective. Whereas in some countries, including Turkey, the concept of transfer pricing could be more advanced. Although Turkey has […]

Latest development of APA in China – simplified procedures of unilateral APA

Background The State Administration of Taxation (“STA”) has made a continuous effort to promote Advanced Pricing Arrangement (“APA”). On 26 July 2021, the STA issued STA Public Notice [2021] No.241 (“Bulletin 24”), which sets forth simplified procedures for unilateral APA for enterprises that meet certain conditions. On 29 October 2021, it also published the China […]

New CEE tax guide outlines fundamental changes and long-term trends

Providing information on taxation in 22 Central and Eastern European (CEE) states, the latest Mazars CEE tax guide analyses long-term taxation trends and fundamental tax regime changes in each country, both now and in previous years.

The Google tax: The UK story, 7 years later

The Diverted Profits Tax (DPT), or what the media have dubbed the Google tax, was introduced in 2015 to dissuade and counteract contrived arrangements used by large multinational groups that divert profits from the UK and erode the UK tax base.

New Transfer Pricing Bill Passed in Israel

Transfer Pricing Bill in Israel passes third reading in June 2022 and is approved. What are the implications for businesses in Israel? In June 2022, the new transfer pricing bill was approved. This is another step towards the Israel Tax Authorities (ITA) efforts to streamline the ITA’s supervision and control of transfer pricing relating to […]

Questions raised on Italy’s penalty protection regime

Following Italy’s new transfer pricing (TP) requirements1 introduced on 23 November 2020, there has been much discussion as to whether the taxpayer may benefit from penalty protection that also covers additional withholding tax otherwise due when the Italian tax authorities (ITA) perform adjustments that recharacterise the nature of a transaction. A Circular2 letter was then […]

Are you ready for the GloBE tax challenges?

On 14 March 2022, the OECD published a comprehensive commentary and illustrative examples of how implementing the Global Anti-Base Erosion Model Rules (GloBE rules) could look. In this blog, we discuss the GloBE rules and examine how the rules apply and filing requirements. On 20 December 2021, the OECD published model rules that member countries […]

What to expect from South Africa’s advance pricing agreement programme

A proposed model for establishing an advance pricing agreement (“APA”) programme in South Africa (“SA”) was issued by the South African Revenue Authority (“SARS”) during December 2021. This article highlights some notable aspects of this proposed programme, by comparing it to those of other jurisdictions. An APA is an agreement between a taxpayer and a […]

Takeaways from the latest edition of the OECD Transfer Pricing Guidelines

On 20 January 2022, the Organisation for Economic Co-operation and Development (OECD) released the 2022 edition of the OECD Transfer Pricing Guidelines for Multinational Enterprises and Tax Administrations (OECD TPG). This blog provides a summary of the revised Chapters of the OECD TPG, and highlights what tax advisors and taxpayers need to know. The revised […]

Transfer pricing: is Africa ready for advance pricing agreements?

Advance pricing agreements (“APAs”) could provide taxpayers and revenue authorities with some certainty during the unprecedented times that we are living in. The African APA landscape is however underdeveloped, but some recent developments in South Africa (“SA”) indicate that this may be changing. On 18 December 2020, the Organisation for Economic Co-operation and […]

New transfer pricing requirements in Italy

On 26 November 2021, the Italian tax authorities (“ITA”) issued the final version of Circular Letter no.15/E (the “Circular”), providing clarification on the new transfer pricing requirements introduced by Measure no. 360494 (“New Measure”) on 23 November 2020. This article analyses the most important amendments to the transfer pricing documentation rules in Italy, and what […]

Nigeria’s simplified compliance regime for non-resident suppliers

Many tax jurisdictions encounter difficulties exercising their tax legislation against taxpayers who do not reside in their jurisdictions. The adoption of a simplified registration and collection mechanism is one of the approaches suggested by the OECD to address these difficulties. The simplified compliance regime is more appropriate for business-to-consumer (B2C) transactions as most B2C customers […]

BEPS 2.0: The future impact on businesses in Singapore

Rapid digitalisation and globalisation have led to significant changes in business operations. The digital economy has also uncovered vulnerabilities in the basic rules that have governed global taxation in the past, creating opportunities for profits to be “shifted” to lower-taxed jurisdictions, and sparking debates surrounding a ‘fair’ allocation of taxing rights. Against this backdrop, the […]

South African approach to BEPS and transfer pricing in light of Covid-19

The South African (“SA”) tax regime is being strengthened by the implementation of base erosion and profit shifting (“BEPS”) action 4, relating to the limitation of interest deductions, but extra borrowings by businesses to deal with Covid-19 has caused the Government to defer its introduction. This article highlights some aspects relating to the implementation of […]

Key transfer pricing considerations for startups

Startups and entrepreneurship are concepts that have recently grown more important globally. To put it simply, startups are entrepreneurial companies that are generally established to offer solutions to any problem and exhibit rapid growth potential. In many countries, the importance of technology-oriented startup business models is gradually increasing, and a rising number of “unicorns”[1] are […]

Agreement on OECD pillar 1 and 2 proposals (as refined by the US initiative)

As of 13 July, 132 of 139 jurisdictions (including Bermuda, Cayman Islands, BVI, Switzerland, and the Bahamas) agreed to the OECD Pillar 1 and 2 proposals as refined by the US initiative. The seven that did not were: Ireland, Estonia, Hungary, Barbados, Kenya, Nigeria, Sri Lanka. The OECD press release can be found here and […]

Tax aspects of opening a business hub in Asia

The Asian Development Bank has forecast that developing Asia’s growth is forecast to rebound to 7.3% in 2021 and 5.3% in 2022. This compares to 4.2% and 4.4% respectively for Europe (see here) and 6.9% and 3.6% for the US (see here). Businesses already with a footprint in the Asian region will be gearing up their operations to deal with the region’s expected […]

The latest transfer pricing updates on Europe, Asia and America

This article identifies the different types of documentation requirements in three macro-areas (i.e., Pan Europe, Asia-Pacific and America) and it explains the thresholds used for the different taxpayers’ obligations. In addition, it provides an overview of the administrative penalties imposed. The countries analysed in the article are the following: Pan European: France, Germany, Hungary, the […]

Transfer Pricing: Is Africa ready for advance pricing agreements?

Advance pricing agreements (“APAs”) could provide taxpayers and revenue authorities with some certainty during the unprecedented times that we are living in. The African APA landscape is however underdeveloped, but some recent developments in South Africa (“SA”) indicate that this may be changing. On 18 December 2020, the Organisation for Economic Co-operation and […]

DAC 6 developments, deadlines, and the question of legal privilege

While the first reporting deadlines for most EU members expired on 31 January 2021 and respectively 28 February 2021, there are still questions outstanding about whether intermediaries are obliged to report arrangements to tax authorities, or if they can use the right to waiver due to professional privilege. In 2020, countries across Europe implemented into […]

Africa is gearing up to fight base erosion and profit shifting

The African continent boasts a beautiful and diverse array of countries offering a wide range of valuable natural and human resources to the world economy. The past decade has seen significant foreign investments in African jurisdictions, ranging from massive investments in Mozambique’s gas reserves to tech companies capitalising on the technical excellence offered by software […]

OECD recommendations on comparability analysis during Covid-19 (Part 2)

Covid-19 has brought unprecedented social and economic challenges that will durably impact the world economy. Specifically, the pandemic has surrounded the Multinational Enterprises (MNEs) with many issues to be managed such as: insufficient cash flows, unpredictable profitability, unreliable third-party data (which is at the heart of arm’s length principle), non-operative supply chains, import/export limitations, possible […]

OECD recommendations on comparability analysis during Covid-19 (Part 1)

Covid-19 has brought unprecedented social and economic challenges that will durably impact the world economy. Specifically, the pandemic has surrounded the Multinational Enterprises (MNEs) with many issues to be managed such as: insufficient cash flows, unpredictable profitability, unreliable third-party data (which is at the heart of arm’s length principle), non-operative supply chains, import/export limitations, possible […]

Developments in transfer pricing documentation

(Updated 30 March 2021) Recent developments in transfer pricing documentation requirements should prompt MNCs to reassess management of cross border tax compliance. With a focus on protecting tax revenues in straightened economic times, many jurisdictions are focussing on transfer pricing compliance and raising awareness of documentation requirements and penalties for non-compliance. This indicates the groundwork […]

Shining the spotlight on more rigorous Transfer Pricing behaviour

While 2020 is a year we may all wish to forget, changes made during the year on Transfer Pricing (TP) give us some clues as to the primary drivers of TP behaviour in 2021. These clues include US guidance from the Internal Revenue Service (IRS) on TP documentation, highlighting the penalty risks; OECD work and […]

Mazars provides comments on the OECD proposals for taxation of the digitalized economy

Mazars has submitted comments in response to the Organisation for Economic Co-operation and Development’s (“OECD”) public consultation on its proposal for taxation of the digitalized economy, released last October. The proposals The OECD project refers to challenges associated with, and proposals to address, the taxation of the digitalized economy. It includes proposals for reforming international […]

Transfer pricing guidelines on financial transactions – have captives been caught?

In February of this year, the Organisation for Economic Co-operation and Development (OECD) released guidance for multinational enterprises (MNE’s) and tax authorities, on applying the arm’s-length standard to controlled financial transactions. The guidance, which the OECD plans to include in the next publication of the Transfer Pricing Guidelines for Multinational Enterprises and Tax Administrations (OECD TPG), […]

OECD guidance about the transfer pricing implications of the Covid-19 pandemic

The OECD released its guidance on the transfer pricing implications of the Covid-19 pandemic on 18 December 2020. This guidance was eagerly awaited by many MNEs whose statutory accounts will be closed by the end of the year, and which need to adjust their 2020 transfer pricing policies to reflect the financial impact of the […]

South Africa and others: broadening the tax base by clamping down on “white collar schemes”

Near-term objective of the South African Revenue Service confirmed: “Remaining focused on international taxes, particularly aggressive tax planning using transfer pricing.” The South African (“SA”) economy, like many others, has been severely impacted by the Covid-19 pandemic. A recent speech by the country’s Finance Minister painted a dire picture of a country that is, in […]

The impact of Covid-19 on transfer pricing

The Covid-19 pandemic has far-reaching consequences, and will have serious implications on transfer pricing for many multinational enterprises (“MNEs”). This is particularly challenging for businesses to manage due to the current lack of guidance from the OECD. With this guide, we review the impact of Covid-19 on: • Transfer pricing treatment of government aid • […]